nanny tax calculator texas

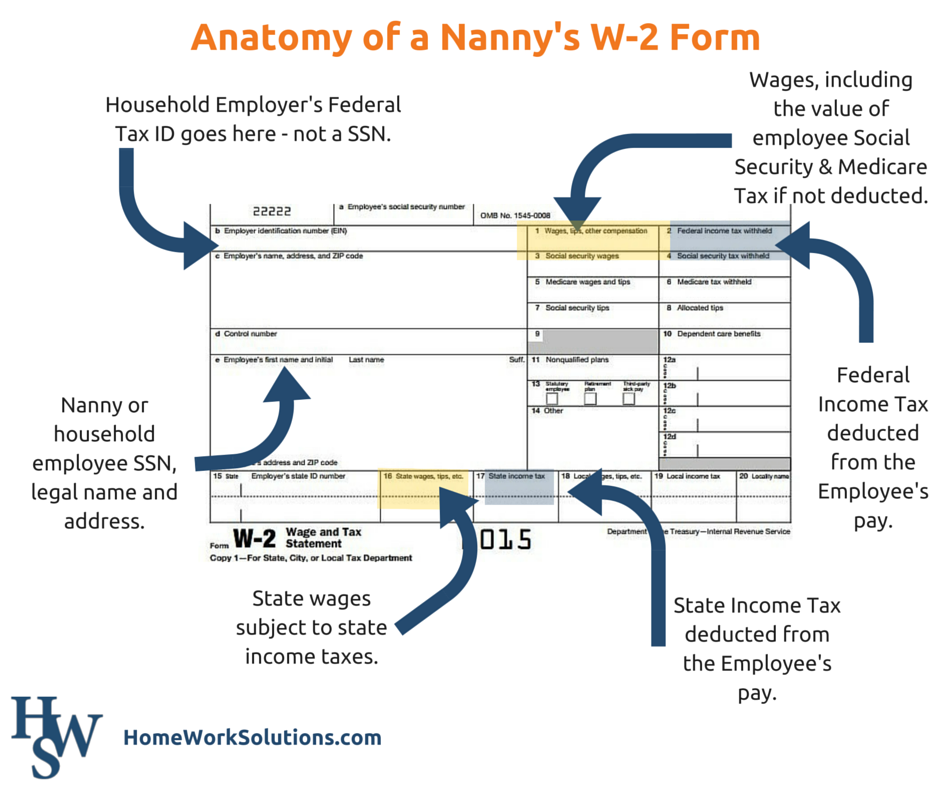

Your individual results may vary and your results should not be viewed as a. How To Create A W 2 For Your Nanny.

Breaking The Barriers To Legal Pay Nanny Magazine

It is then the decision of the employee whether they opt in or out of the scheme you cannot choose for.

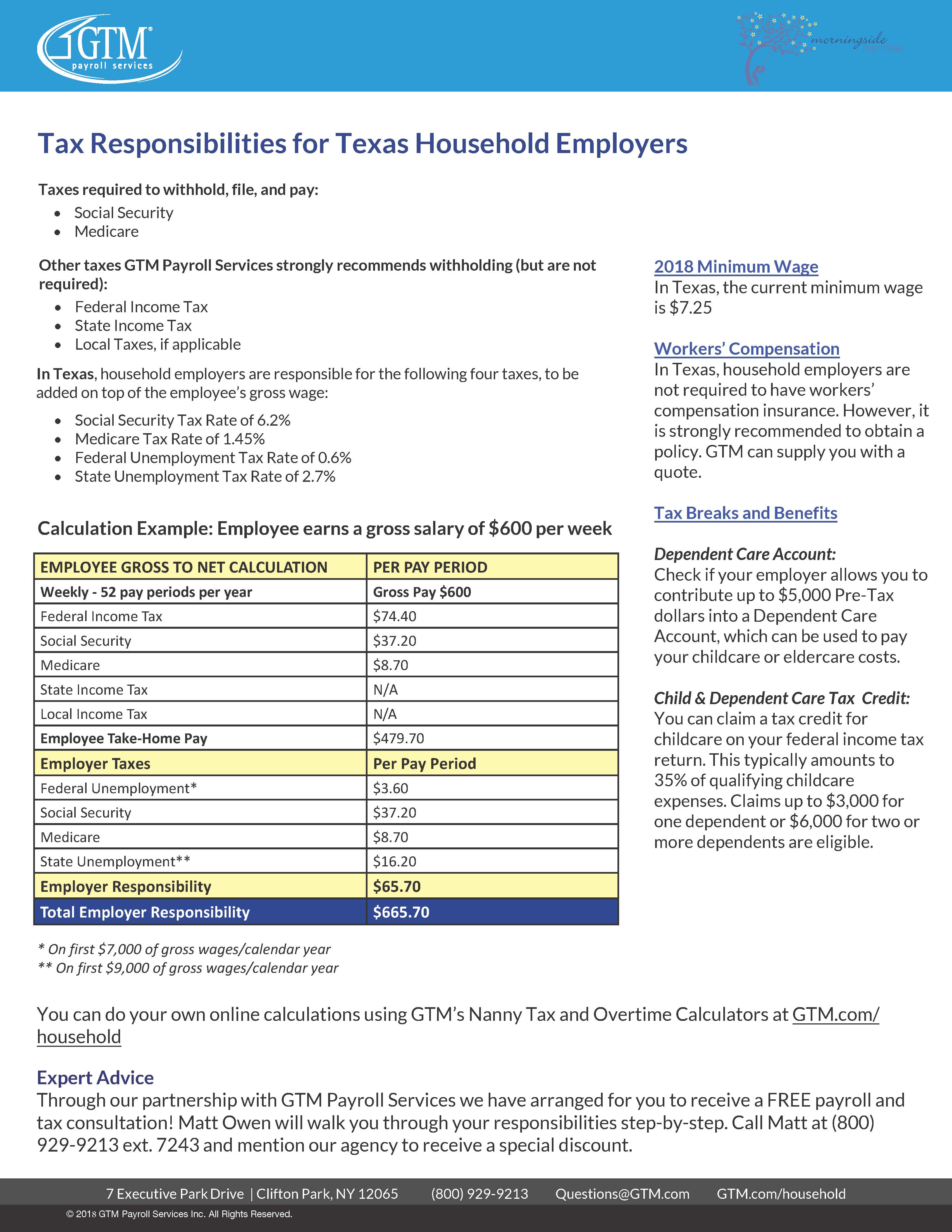

. If you hire a nanny or senior caregiver in Texas learn about all the state household employment tax payroll and labor laws you need to follow. On a quarterly basis. Enter your employees information and click on the Calculate button at the.

You may have seen this type of calculator on the internet when trying to look for information on how to pay nanny tax to the Internal Revenue Service IRS. GTM Can Help with Nanny Taxes in Texas. This calculator allows you to get an idea of how much you will pay and how much your nanny will take home.

Our easy-to-use budget calculator will help you estimate nanny taxes and identify potential tax breaks. Taxes Paid Filed - 100 Guarantee. The Nanny Tax Company has moved.

With the minimum wage in Texas being 725 per hour you can expect to pay a hourly rate between 725 and 20. Note that if your nanny goes over. A nanny tax calculator will help you learn what your take-home pay will be when negotiating your pay rate.

Employee State Tax Settings. Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. There is a difference between net and gross pay.

This calculator assumes that you pay the nanny for the full year. Gross vs Net Tax Calculator Employees Information Payment Frequency Weekly - 52 pay periods per year Bi-Weekly - 26 pay periods per year Semi-Monthly - 24 pay periods per year Monthly -. Our new address is 110R South.

Easy To Run Payroll Get Set Up Running in Minutes. Our Easy-To-Use Budget Calculator Will Help You Estimate Nanny Taxes. These rates are the default rates for employers in.

Call 800 929-9213 for a free no-obligation consultation with a household employment expert. Ad Payroll So Easy You Can Set It Up Run It Yourself. Taxes Paid Filed - 100 Guarantee.

Easy To Run Payroll Get Set Up Running in Minutes. The Nanny Tax Company has moved. This is a sample calculation based on tax rates for common pay ranges and allowances.

Nanny tax payroll service for calculating taxes and providing documentation like paystubs and W-2s. Taxes Paid Filed - 100 Guarantee. This calculator is a.

The amount of qualifying expenses increases from 3000 to 8000 for one qualifying person and from 6000 to 16000 for two. Nanny Tax Hourly Calculator. For specific advice and.

The average cost of a nanny in Texas is 1272 per hour. Taxes Paid Filed - 100 Guarantee. Calculate pay and withholdings using The Nanny Tax Companys hourly nanny tax calculator or salary calculator.

Well answer all your questions and show. You are responsible for federal employment taxes when you pay household workers as little as 1000 in a calendar quarter or when you pay any individual employee age 18 or over 2400 in. As an employer you are obliged to enrol your employee onto a pension scheme.

Enter your employees information and click on the Calculate button at the bottom of the nanny tax calculator. Nanny payroll help can vary from low-cost or free DIY resources to full. You can also print a pay stub once the pay has been.

Nanny tax calculator texas Thursday March 17 2022 Edit. If you pay your nanny cash wages of 1000 or more in a calendar quarter or 2400 in a calendar year file Schedule H. Form C-20 or C-20F for annual filing.

The nanny tax calculator for 2015 and 2016 taxes you will need to enter your nannys gross weekly pay and the number of weeks you paid your nanny. Use our nanny payroll. However in most situations you need to pay 06 for unemployment insurance for the first 7000 you pay your nanny.

Nanny tax calculator for nannies. Ad Payroll So Easy You Can Set It Up Run It Yourself. It is intended to provide general payroll estimates only.

For tax year 2021 the taxes you file in 2022.

Nanny Payroll Services For Households Adp

Nanny Tax Calculator Gtm Payroll Services Inc

Nanny Tax Payroll Calculator Gtm Payroll Services

Nanny Tax Calculator Gtm Payroll Services Inc

How Much Should I Hold Out For Taxes On 500 A Week In Texas I M A Nanny For A Family And They Don T Take Taxes Out Of My Pay Quora

Full Service Nanny Tax Solution Poppins Payroll

Nanny Tax Payroll Calculator Gtm Payroll Services

Free Pay Stub Templates Smartsheet

Nanny Tax Payroll Calculator Gtm Payroll Services

The Temporary Nanny And Her Taxes

What Are Employer Taxes And Employee Taxes Gusto

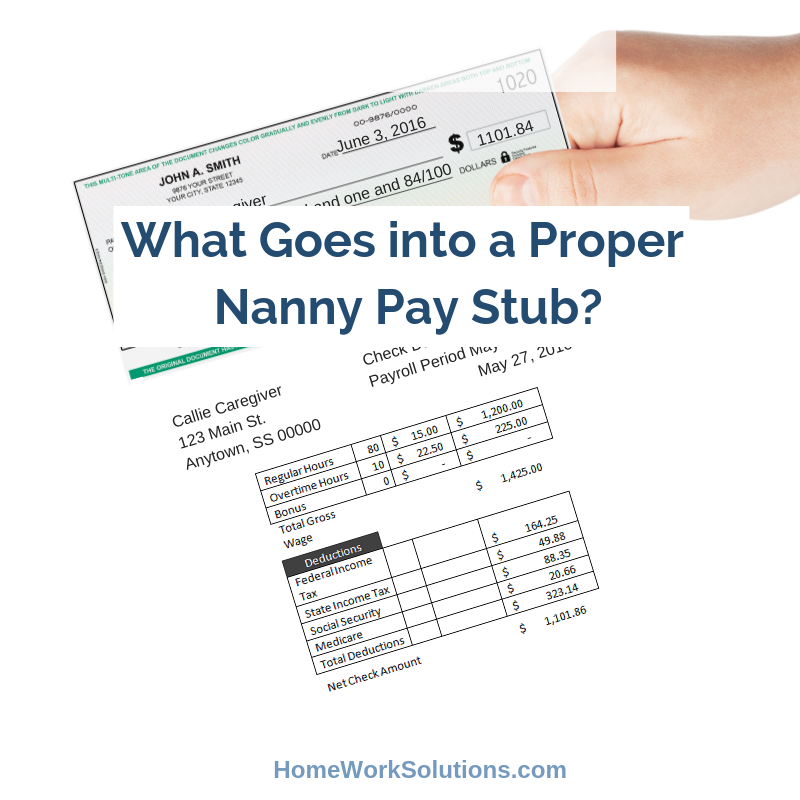

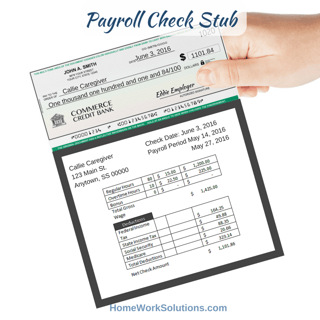

What Goes Into A Proper Nanny Pay Stub

Nanny Tax Payroll Calculator Gtm Payroll Services

Do I Need To Provide Our Nanny Or Household Employee A Paystub

2018 Nanny Tax Responsibilities

Household Employment Blog Nanny Tax Information W 2

The Right Time To Put A Nanny Or Caregiver On The Books Hws